Story Highlights:

• Florida’s housing market is stabilizing, not crashing. Home sales and new listings in 2025 are trending close to pre-pandemic levels, signaling a return to normalcy rather than a downturn.

• Inventory is rising but still manageable. While more sellers are entering the market, inventory levels are far from 2008 levels and are not high enough to cause a major price drop.

• Prices in Orlando are holding steady. The median home price remains flat year-over-year, with no signs of dramatic increases or collapses — a soft correction is underway.

• Buyer demand is softer, but options are growing. With more listings and stable pricing, buyers have more choices — especially in areas with more affordability pressure.

• Relocators and sellers should stay strategic. Long-term fundamentals in Orlando remain strong, and pricing competitively is key in today’s more balanced, opportunity-rich market.

Is the Florida Housing Market Headed for a Crash in 2025?

There’s no shortage of headlines speculating about the housing market — from whispers of price dips to debates about interest rates. So, what’s really happening here in Florida, and more specifically, in Orlando?

Let’s take a look at the latest trends in sales activity, inventory, pricing, and forecasts. Whether you’re looking to buy, thinking about selling, or planning a move to the area, here’s what you should know about the current housing landscape.

Are We Back to Pre-Pandemic Sales Numbers in Florida?

Believe it or not, we are. In March 2019 — right before the pandemic — Florida saw about 25,000 home sales. In March 2025? Nearly the same number. That tells us something important: the market is stabilizing.

Compared to the chaos of the last few years, this return to normalcy is a good sign. Yes, buyer activity has been a little slower in some months, and yes, affordability continues to be a hurdle with today’s interest rates. But the fact that we’re settling into familiar territory could mean the market is finding its footing.

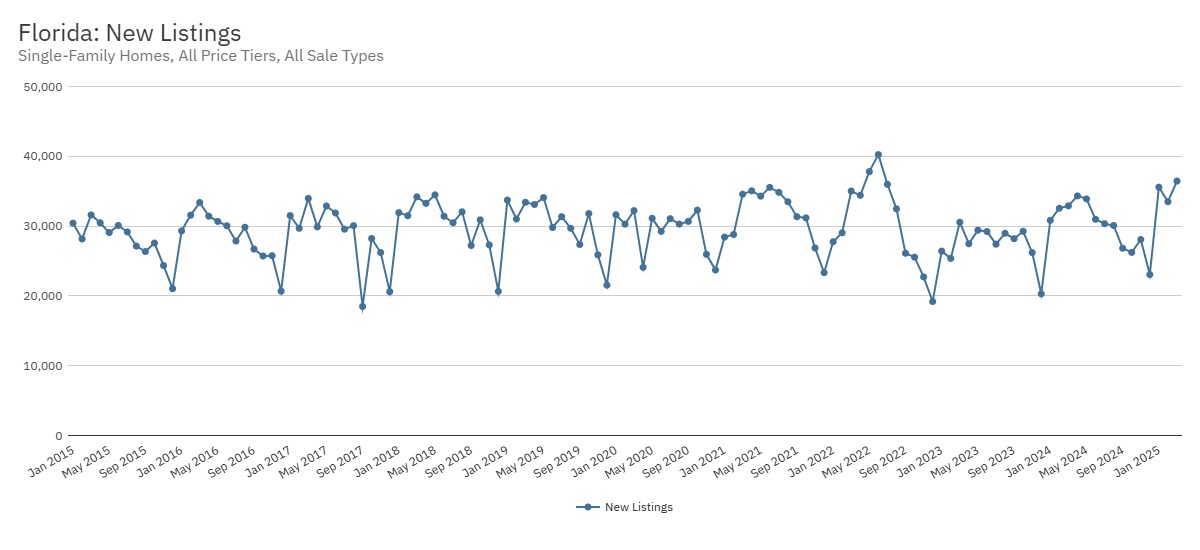

Are More Homeowners Listing Their Properties in 2025?

They are — and this is one of the most noticeable shifts this year.

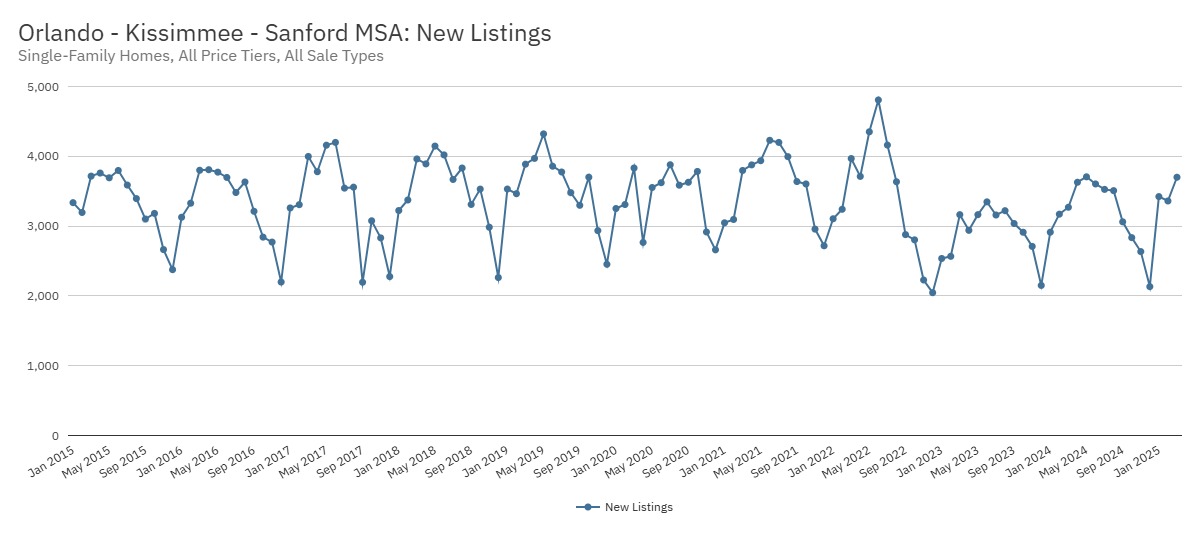

In early 2025, we saw a strong increase in new listings across Florida, with some months posting double-digit growth compared to last year. Orlando followed suit, especially in March, where listings jumped 13% over the previous year.

That doesn’t mean a flood of inventory, but it does signal that more sellers are stepping off the sidelines. Some are testing the market, while others are serious about making a move. Still, about 10% of homes are being withdrawn before they sell, which shows sellers are holding firm on price expectations.

Is Florida’s Inventory High Enough to Cause a Price Drop?

Not at this point.

Yes, inventory has grown — Florida currently has about 114,000 single-family homes on the market. But in context, that’s still a far cry from 2008 levels, when the state had nearly double the number of active listings, and with a smaller population.

In Orlando, the inventory story is similar. We’re seeing more options, but nowhere near a glut. In fact, when adjusted for today’s larger population and housing base, we’d need tens of thousands more homes on the market to see significant downward pressure on prices.

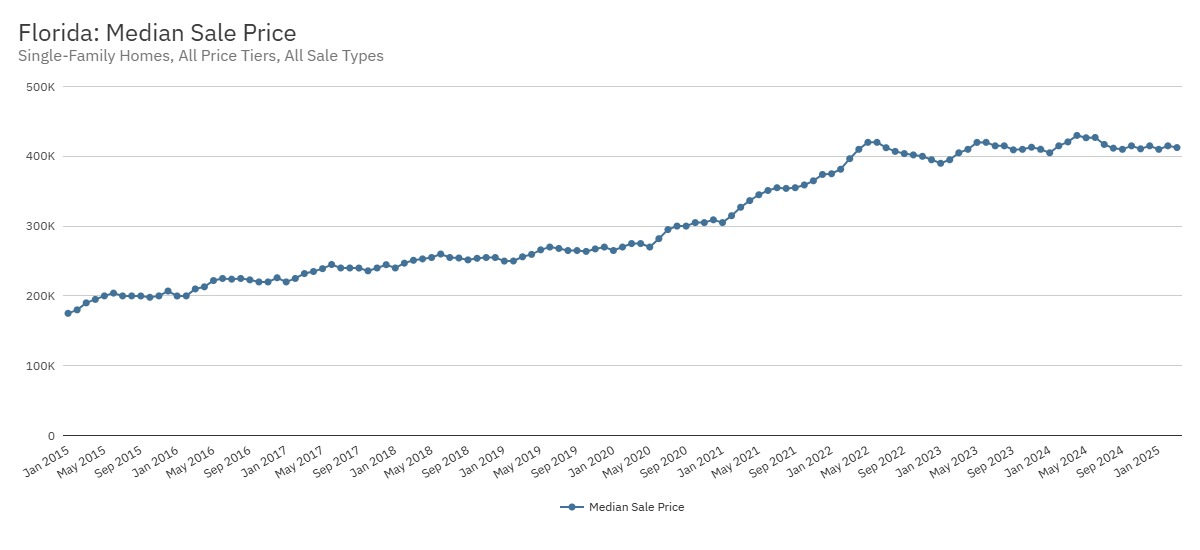

What’s Really Happening with Home Prices in Orlando?

Prices in Orlando are holding steady. The median sale price is around $441,800, nearly flat compared to this time last year. That might not sound exciting, but flat pricing in a historically appreciating market is a sign of a soft correction — not a collapse.

Statewide, some regions like Naples and North Port have seen 5–8% year-over-year price declines, while others, including Orlando and Miami, remain close to even. Higher-demand neighborhoods like Winter Park, Dr. Phillips, and Lake Nona are still performing well and, in some cases, trending slightly up.

What Does This Mean for Buyers, Sellers, and Relocators Right Now?

Here’s how to think about the current market, depending on your goals:

If you’re a buyer:

There’s more to choose from than in recent years, and less competition in some price points. While affordability is still a factor, especially with rates where they are, you may find better opportunities in areas that have softened slightly. It’s a more balanced playing field.

If you’re a seller:

Pricing strategically is more important than ever. Buyers have more options, but well-priced, move-in-ready homes are still attracting strong interest — especially in desirable neighborhoods. Overpricing can lead to longer days on market, but realistic listings are still moving.

If you’re relocating to Florida:

This is a more stable environment to make a move. You’re not walking into the bidding wars of 2021, and you’re not overpaying into a bubble. Inventory is growing, prices are holding, and long-term fundamentals — like job growth and population gains — remain strong in markets like Orlando.

So Is This a Correction? And Should You Be Concerned?

We’re in what some would call a “sideways correction.” Prices aren’t plummeting, but they’re also not rising the way they typically do. Historically, Florida sees about 5% annual price growth. When the market goes flat for a couple of years, that’s a correction in itself — it’s just not the dramatic kind that dominates headlines.

Think of it as the market taking a breather after an extraordinary run-up during the pandemic. That pause might actually be healthy — giving buyers more leverage, sellers a reality check, and everyone a bit more predictability.

Final Word: What’s Next in the Orlando Market

The housing market in Florida, and especially Orlando, isn’t crashing. It’s rebalancing. After years of extreme growth and limited inventory, we’re now seeing a more sustainable pace. Interest rates remain a wildcard, but even those are expected to ease slightly this year.

If you’re planning a move, considering an investment, or wondering whether now is the right time to list, the answer depends less on trying to time the market and more on your personal timeline and financial goals.

The fundamentals in Orlando remain strong — and while the pace may have changed, the long-term outlook is still solid.

Why Choose Jared Jones?

As a top real estate agent with nearly 4,000 homes sold and over 20 years of experience in the Florida real estate market, I have the expertise needed to help you navigate today’s evolving landscape. Whether you’re looking to buy or sell, my deep understanding of market trends and personalized approach will provide you with the insights and strategies required for success.

Best Realtor in Orlando - Reach Out Today!

If you’re ready to make a move in Florida’s real estate market, don’t hesitate to reach out. Contact Jared Jones at 407-706-5000 (call or text) or email info@jaredjones.com for professional guidance and personalized service that will help you achieve your real estate goals.

Search Homes in Orlando, Florida

Jared Jones Real Estate Team Serving All of Central Florida

- Osceola County

- Orange County

- Lake County

- Polk County

- Seminole County

- Volusia County

- Broward County

- Marion County

- Flagler County

- Brevard County

- Pinellas County

- Hillsborough County