Key Points:

- Pending Home Sales Trends: Orlando saw a decline of 5.1% recently, better than other Florida metros, but still concerning.

- Winter Park’s Tight Inventory: Active inventory in Winter Park’s 32789 is 50% below pre-pandemic levels, signaling constrained supply.

- Collapsing Cash Sales: Cash sales in Winter Park have dropped significantly, with some months showing a 40% decline.

- High Insurance and HOA Costs: Rising costs for repairs, insurance, and HOA fees are creating affordability issues for buyers and owners alike.

- Divergent Price Trends: While median sale prices in Winter Park remain relatively stable, surrounding areas show signs of softening.

Winter Park Market in the Eye of Contradictory Headlines

Orlando real estate renegades, I hope you are well. Man, oh man, we have headlines in all directions and today we are going to take a deep dive in understanding how these crazy headlines are affecting us here in Orlando, specifically if you live, own, or considering buying in the Winter Park marketplace, because here’s the diversity of what we’re hearing in the news. I just caught an update on Channel 2, local Orlando news station said, hey, Florida is cooling down amidst the hurricanes, high insurance, all these other factors.

This is a problem in Orlando is hitting a wall. At the very same time, in a matter of few weeks, there are headlines now saying that we have been on a four to six week run where housing affordability is ceasing to become a problem. It is now abating and that we’re seeing a resurgence of buyers to the market.

Buyer Opportunity vs. Investor Exodus in Winter Park

So how can it be? How can we have these divergent messages on one hand saying, hey, you buyers, you’ve been waiting, your time has come. You can now afford a property. And on the other hand, you have similar headlines saying that right now, record numbers of investors, the ones that have been fueling the Florida market for probably the better part of six years, they’re no longer here.

They’re leaving the South. And that for everyone else, the mass hordes of around 400,000 people that seem to move to our state every single year are somehow now finding the climate disasters to be such a new thing. They no longer will move here anymore.

It’s such an appealing place. It’s, it’s pretty vicious. And honestly, if you look at the storm patterns and all of that, really, it’s kind of isolated to one side of the state for the past 10 years.

But I will say none of that is good for insurance. And that has been a draining hammer on all costs associated to owning a home. You have not just higher costs from the inflation of building material.

Hey, if you’re going to fix it yourself and go to Lowe’s, it’s more. If the insurance company has to get a claim on your house and they have to fix it, it’s more. If your HOA needs to fix something in the community, they call their insurance.

Meaning that if you’re out there in the market and you’re looking to buy a home, you’re going to get some meaty concessions. I’m going to show you the data. I’m going to give you some exact scenarios and some things to think about no matter which side of this fence you’re on, so that you can make great decisions here in the winter of 2024 and also the spring and summer cycle of 2025.

Let’s get into it.

Winter Park Housing: Rising Costs and Market Shifts

Everybody is stacking cost on cost. And this isn’t isolated to Florida. This is a factor of what we have been seeing rampant inflation is putting the squeeze in particular on homeownership.

And more and more reports are even saying that a high percentage of renters, like a quarter of them are paying nearly all of their salary just to rent. And when rent is a discount to owning and owning costs, even more, you can understand that there’s a lot of divergent pressures in the housing market as it stands right now. And while I cover what you’re seeing on local news, dispel the myths, understand right after this, I’m going to show you how this news affects you.

I’m going to look right into the data for you. If you are in 32789 or 792 or looking to buy there, stay tuned. We’re going to get right to that.

And here’s the headline, Florida housing market cooling down amid high insurance rates and active hurricane season. A Redfin study found that five us metro areas with the biggest declines are in Florida. I’ll save you this article because they are citing another one.

Winter Park Market Update: Trends and Insights for 32789

I’m going to take you to the actual report at hand, which does bring up Orlando. And this is why channel two had covered it. The actual report here says Florida is home to the five us metropolitan areas where pending home sales are falling fastest.

Now understand this when they’re saying, Hey, you know what? The top of the list, five of the metropolitan areas with the slowest pendings, understand that they’re reporting that buyer activity is falling off a cliff. They’re saying, Hey, you know what? If you had all the major metros in the U S the top five that aren’t pending homes, which is basically a leading indicator for a closing, a buyer then goes, finds a home puts under contract. 85% approximately of pendings will actually close.

Remember all pendings, all homes go under contract. Do they close? No, they don’t. They fall out because of inspections.

They followed if the appraisal comes in low and the seller doesn’t want to budge on the price, different things like that affect a sale and ultimately hinder it. If you have pendings falling off, you will have a higher level of unsold inventory, stagnancy in the market, frustrated sellers, disillusionment, increasing price cuts, increasing time on market. All those things indicate recessionary pressure.

At least this will be the tone of the article. Now let’s take a look at what it says in Fort Lauderdale, pending home sales dropped 15.2% year over year during the four weeks ending November 10. This is recent data.

The biggest decline among us metropolitan areas. Repanelized next came Miami at negative 14% West Palm beach at negative 14% Jacksonville, negative 10 nearly and Tampa 7.2. Now notice Orlando is not mentioned at least in this particular section, but if you scroll down it says the drop in pending home sales has eased in other Florida metros in Orlando. For example, pending home sales fell as much as 14% during a previous four week set.

So they’re saying basically if we had taken this report a week earlier, Orlando would be on the list, but it says during the most recent it’s down just 5.1. So in Orlando, by the way, in all the marketplaces is out of late been the darling of all the four major metros in Florida. So you’re considering Jacksonville, Miami, Tampa, and Orlando. You’ve been largely seeing Tampa and Jacksonville leading the charge, but as of late, we are seeing a shift.

My friends, Miami is slowing down and slowing down aggressively. So Miami has become one of the biggest shifts from a strong seller’s market. When even Orlando, Tampa jacks were going slow.

Miami was on a tear and it has, they hit their brakes as fast as they were on fire. Up to this point, they were raging hot. They were the darling of Florida.

They had a huge percentage of cash purchasing power because people will come there. They don’t need mortgages. They just pick a house and close at high percentages and all as fast as it grew up, it has come to a stop.

Now I will also say that I’m watching Redfin’s most recent date on Orlando, and we’re having a recent trend where sellers are pulling back from pushing so many homes to the market. So in all of this, you have to understand the only saving grace with this economy, the way it is, we have record low closing volume in Florida, record low in the entire us, but record low amount of closings now and last year, because ultimately you just have a situation where people that are in homes now with their low 2.75, 3% 30 year, they’re golden handcuffed to that situation. And you have a situation where buyers want to buy.

And you have a situation where buyers themselves are on the fence for reasons we stated high insurance, high HOA, and all these things. But on a net balance, Orlando is the most neutral market of them all with a huge, tremendous amount of growth. I’m not here to hype up.

I’m not here to be a bull for housing. I’m not here to be a bear for housing. I’m here to call it as it is.

So I’m going to show you the data and say, all right, how do we stack up in the state of Florida, the state of Florida, just like Texas, you got to understand is leading the country in softness, but let’s look directly. I have recent data on winter park. It’s what you came to see.

Let’s dive into the update. Hey, I’m interrupting myself to ask you, are you thinking of buying or selling a home? Make one call. That’s all.

And put my 23 years of experience in nearly 4,000 sold homes to work for you. All right. We’re going to start with 3, 2, 7, 8, 9. The data you see here on the screen, this is directly from the backend of the Florida association of realtors.

If you’re not licensed, you cannot access this information because we get it as realtors with our license. We can log in and see granular detail of the data going back in history. So just want to tell you that upfront, because people are going to ask in the comments.

Winter Park Active Inventory

Understand when it’s gray, it means that some places around the U.S. have buyers who can ask for anything, and the sellers will probably do it.

There are places where there’s a lot of competition, but this is an interesting narrative because look at how in the past, the trend—look at the trend.

So here we are going at the end of 2023, there was one period of neutrality. Look at this. When we had the first time in interest rates were raised by the Fed and all of a sudden it shocked the market because right here, interest rates were like 3%.

Then they jacked them up to overnight, 7%. Interest rates freaked everybody out, and the market went to two periods. But look where it is now.

So now we’re now bottoming towards one of the lowest periods on record for a seven-year run.

Cause this chart goes all the way back to 2018. You can see, and again, it needs two or three more periods of kind of a decline, but you can clearly see what’s happening.

Winter Park Cash Sales

Now, the next thing I want to show you is cash as a percentage of closed sales.

This is a wild phenomenon that we’re seeing right now in Florida, which could add more supply to winter park. Look at how much of a dip we have seen over the past year and a half in cash sales. Look at it’s all negative, negative 41% cash sales, negative 37, negative 15.

So one of the only likely softening indicators I’ll be able to show you here. I don’t think I’m gonna have any that are soft for this market, except for this, this is a phenomenon that’s growing all over Florida. This is fascinating to me.

So for whatever reason, something is happening where the market from the cash buying perspective has absolutely tightened up. Look at it. The trend in may, it was negative six.

Then it was negative 14, negative 16, negative 15. And it’s growing wider towards the end of the year. And this is a phenomenon in high cash markets like Miami, Miami is doing the exact same thing for whatever reason.

It’s either that there’s some kind of tension and liquefying or having liquidity provided from whatever the other asset sources. I have a house in X market. I can’t sell it, but if I would, I could, and I bring all my cash and buy the home in winter park or Miami or wherever.

So this is a fascinating phenomenon that we’re now seeing happening across the marketplace. And the reason we want to watch it here is because in the history of this market, there’s a lot of It’s anywhere from 40 to 60% in recent history. It’s usually not this low.

In fact, the October 2024 number, which is the most recent number on record shows 29%. That’s a number that you haven’t seen in this market since August of 2022.

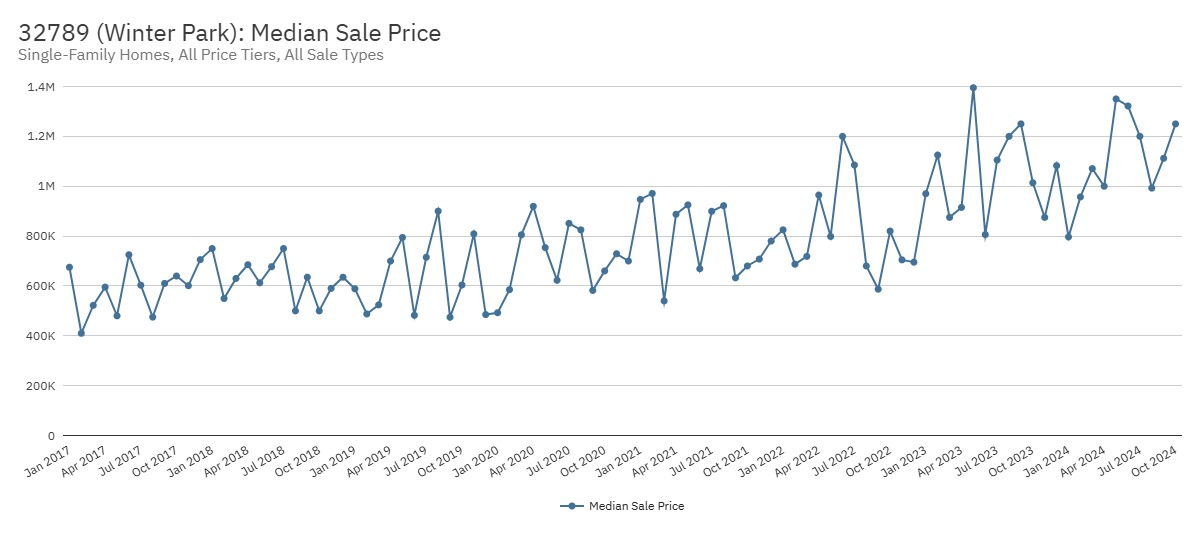

Winter Park Median Sale Price

The next chart we’re looking at is median sale price, safest trend to look at when you’re in a marketplace that has a wide variety of price points.

Like winter park does really, you can’t grasp a month to month approach here. It’s going to be up one month down the next up one month down the next. And you can see it’s all over the map.

But one thing that you can gain from these kinds of visuals is look at the larger trend. And you can see that the price point isn’t so stagnant as it has been in the past. And ultimately it’s still been growing largely when the rest of the Orlando market has been very stable, very flat for two years running.

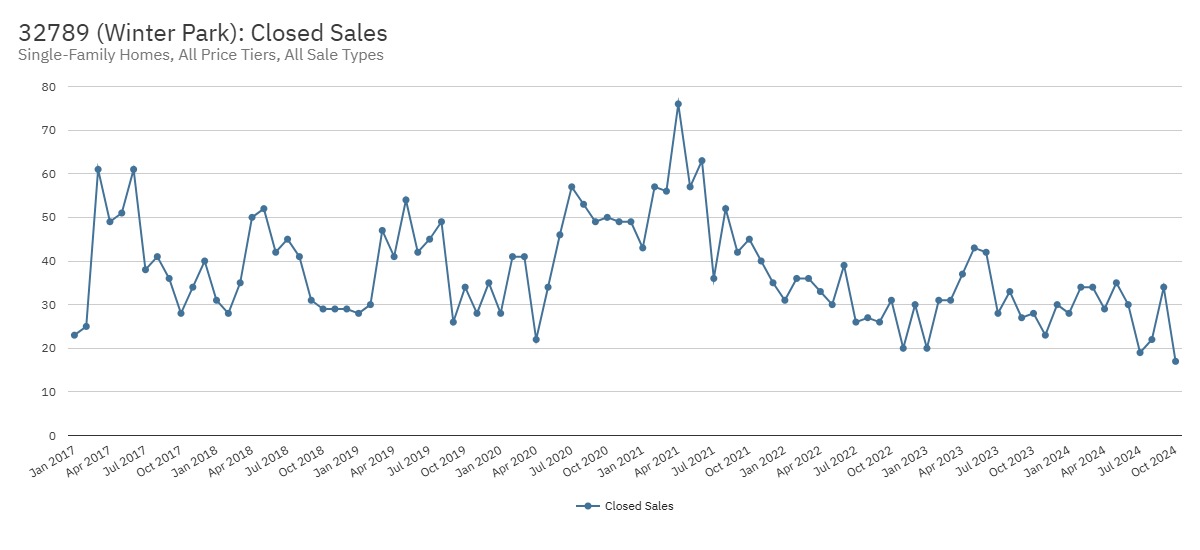

Winter Park Closed Sales

All right. The next chart we’re gonna look at is closed sales, and you can see the closed sales have looked way better in the past. As you can see, there’s been much more high points in the pandemic era and even pre pandemic right now.

It’s just been in a bit of a slump. Most of the time it’s below this 40 unit mark. It never surges above it.

And even now it’s all less than 20 sales, which was a 40% fall off last month. Remember, look what happened in tandem. You had a 40% disappearance in cash purchasers.

And ultimately, what do you have at the same time? You have high interest rates. So if all the rest of the buyers are facing 6.75, 7% interest rates, that’s going to cause a problem when your cash buyers walk. And another thing too, is just this market still has very tight supply.

Ultimately, if there were higher amounts of unsold active inventory for buyers to see, you know, if it were closer to 200 than 100, that for sure has implications on Winter Park. And again, that is very unique in the market. This particular market has challenges that other markets do not have in Orlando.

Most of the areas around Orlando, there’s a lot of supply and the buyers are just a little bit anemic and not picking them off. And so it’s stacking higher and higher. Winter Park does not have that issue.

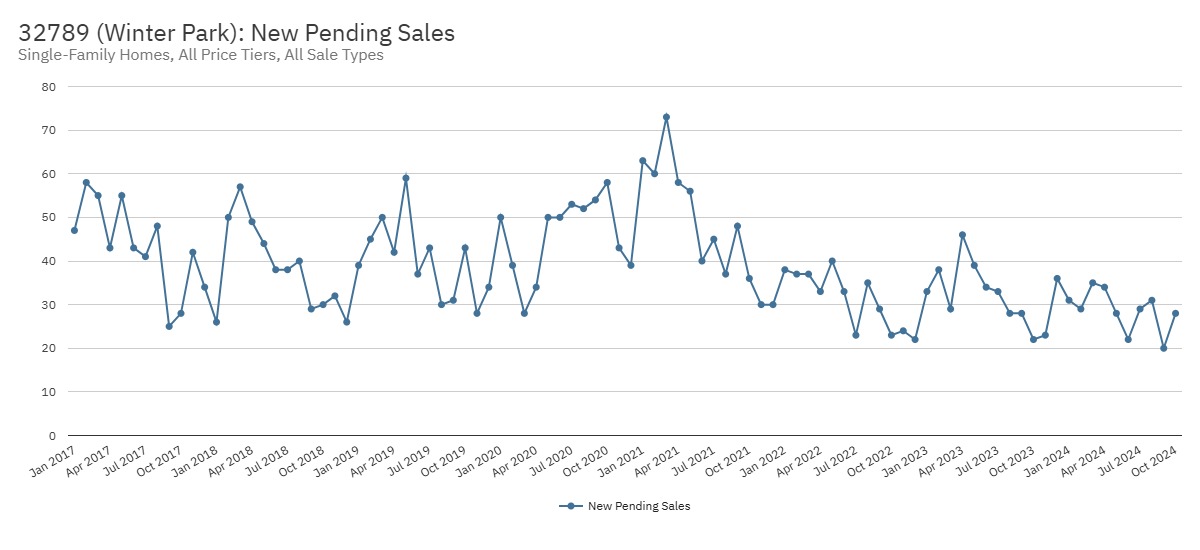

Winter Park New Pending Sales

When closed volume is down, we want to look at things like, is there a deluge of new listings come in the market? Are buyers backing away and not putting properties in a contract? Remember, we just saw these reports that pending home sales throughout the state of Florida were down 14, 15%. We’ll look in Winter Park. They were up 27% last month, down 29% the month prior.

The month before that in August, they were up 10, down 12, down 35, down 28, down 26. So there’s a lot of back and forth. And again, I think a lot of the new pendings here is a pressure point of, again, diminishing cash buyers and also the fact that there’s just very low supply. I do not expect to see that listings are very high here, but let’s check it out.

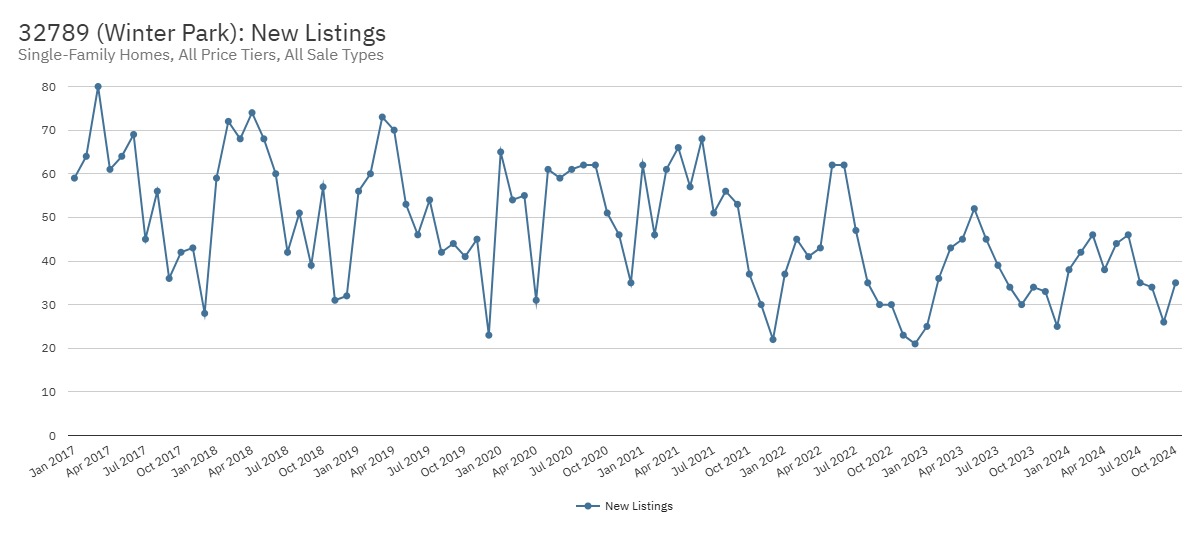

Winter Park New Listings

Now for a market to crater, for you to see soft spots, one of the biggest things that everybody looks for is how many sellers are getting desperate. How many are rushing homes into the market? This is something that we have just not seen in Winter Park.

Look at this. Out of the last six months, there is no inventory. It’s trailing beneath last year.

Last year was low and 2024 is even weaker. So ultimately a lot of the folks in Winter Park are staying put, and it’s not a surprise. If you’re not seeing new listings, the folks that own these homes aren’t moving.

They don’t want to worry about having cash to go somewhere else. They don’t want to worry about barring my high rates. And ultimately that just keeps the market very balanced.

Okay. Now, if this changes, and I think it could, okay. So a lot of times when you see long running trends in this area, like this, okay, this is something I would tell for you buyers.

If you’ve been sitting on the sidelines and a lot of folks that my buyers in the past that want to buy in Winter Park, they have very specific criteria. They want this, this, this, something about the lot square footage, something about the house build, something about home features. They get to be very specific in this particular marketplace.

And what I’m seeing and what I would encourage you, if you are buying in Winter Park and all of my buyers, I’m telling them right now, Hey, when we see a straight six, seven month week trend of new supply in the market whole fast, because you are likely to see another five, six, seven months of plenty following this a little bit of drought where sellers have been holding off because natural life consequences, all kinds of things that create situations where sellers must sell. These are going to stack up. It just, it’s the reality of the marketplace.

It doesn’t stay anemic forever. So I wouldn’t be surprised in the next few months. If you see our inventory start to go towards one 50, as we go into the spring months of 2025

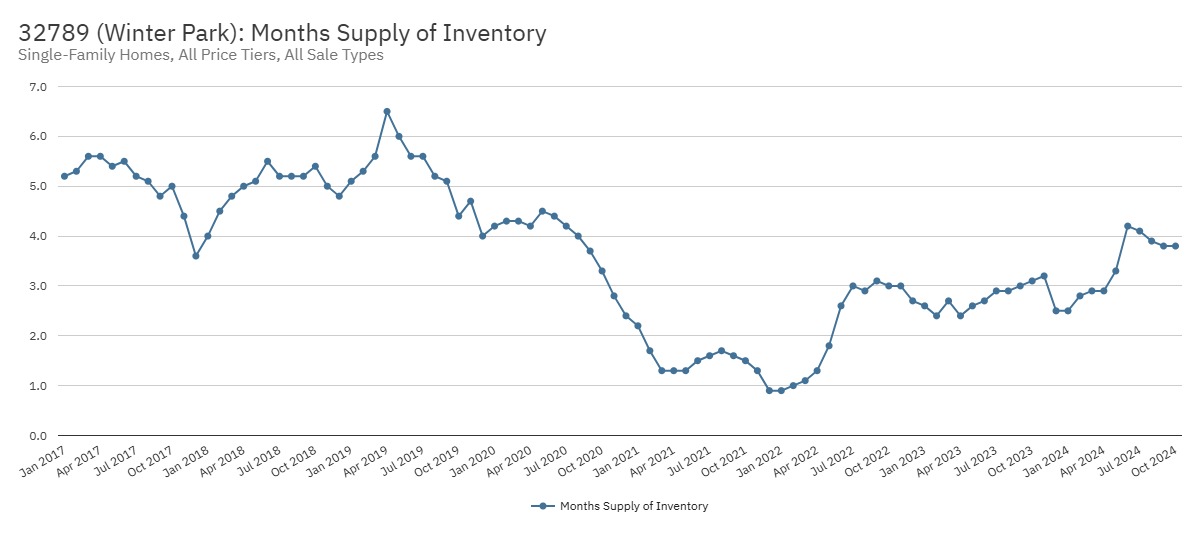

32789 (Winter Park): Months Supply of Inventory

This is the velocity of the market. This is activity at the most basic measurement. This is my favorite supply and demand measurement that exists for real estate.

And you can see here 3.8 months of supply. What this means is if you stop listing inventory in Winter Park, just cut it off the volume and pace of buyers at this particular market has every month would sell every home off in just under four months. Now, 3.8 months is interesting because this is right on the national average for this market to turn in a 3.8, a four month supply with half of its pre pandemic inventory.

This is a very clear signal to me that the buyers are just backing away. And if you do have a resurgence of listing inventory, I feel like this will pretty fast. And ultimately what will that do? Jared, that will change the vibe and the feel of selling a home in Winter Park.

That will change the sense of how fast, how many buyers I have for me, how, how things will flow through the sale process. That dynamic will feel different and it can feel different very dramatically. Unless these cash buyers return, these buyers jump back in the market.

And if that doesn’t happen, hopefully that we see interest rates dropping. And most people are not putting bets on that with the incoming administration for presidency. And I’m not trying to get political, but just on balance, just on a market analysis, there’s belief that we might see interest rates a little higher for longer.

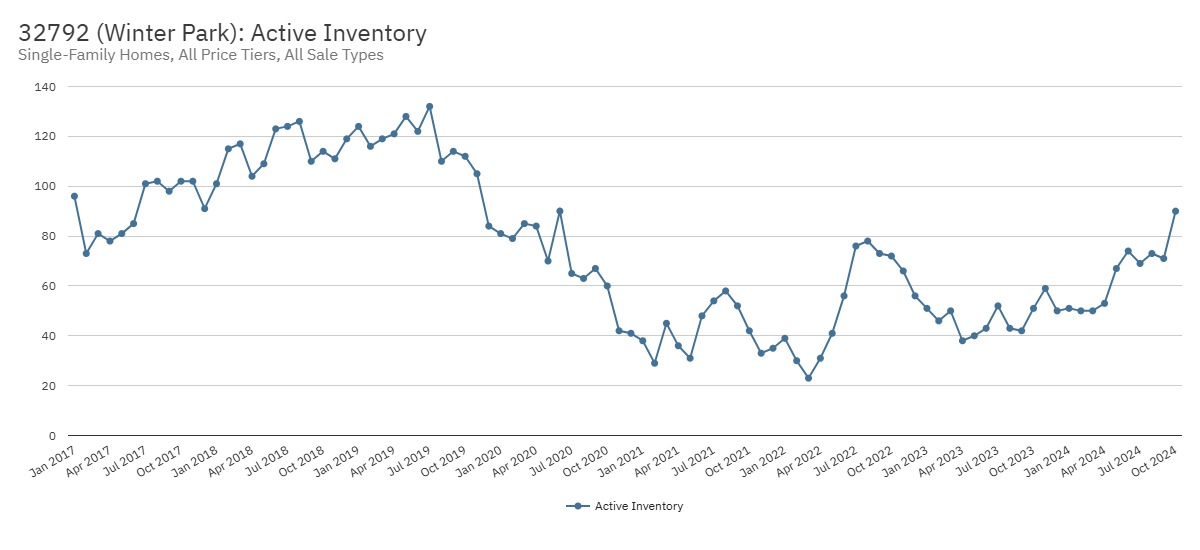

32792 (Winter Park): Active Inventory

This marketplace is slightly a little less active, I believe than 789, but take a look at this.

There’s a little different picture here. It’s still a tight market. We’re looking at active inventory.

If you’re just joining, kind of jumping in because this is the part of the update you want to see. I am starting here on January of 2017, all the way to present. I’m giving you a historic view because this particular anomaly right here, when interest rates were at two and a half, 3%, this is a rare site for the entire housing market and ultimately weird things happen.

So we need to look and balance at what is happening today. You look down here, you could take a snapshot and see that the most recent data we have shows that inventory unsold homes is 77% higher than last year. This is much higher than 789 zip code, the neighboring zip code, which was around 11, 12%.

It was a very small number. And ultimately, if you looked at its inventory level, it just was like straight flat. But here in 792, things are a little bit softer, but it’s not something that the buyers can cheer about.

So if you’re on the sidelines, you’re like, Hey, I’m going to get a house because it’s flooded with inventory. Look at pre pandemic levels. This market held 120 units before those two and a half, 3% 30 year fixed rates showed up and sold off all the inventory.

So this particular housing markets, normal feel is around a hundred, 120 units, which is interesting because in 789, it’s closer to 200 units in history and they’re running at a hundred units now. Okay. So here’s the thing.

This number of currently 90 unsold homes is growing fast. Okay. There is something happening far different in 792 than is happening in 789.

Look down here. They were running 59, 50 units, 50, just a flat one year ago. Okay.

So this is a huge jump and look at how much of that jump took place just in moving season. Okay. May 67, 74, 69, 73, 71.

The numbers are getting higher since the peak of the season. Okay. The numbers were not supposed to be going off of the charts during one of the most volatile actively purchased months.

Pendings are usually dwarfing all the prior months. I mean, they’re going way up. Buyers are absorbing a lot of the supply that comes to the market in the summer.

And ultimately what happened is there was a little bit of a reversal on that. We can see that recently. So something’s happening.

You say, Jared, is the market dying? Is it getting bad? Well, we’re going to find out because one of two things is happening here. Either you have a flood of sellers dropping houses to a pace, which the buyers can absorb them or your buyers have packed up their bat and ball and went completely home. We’re going to find out which one it is.

You’re going to know exactly what’s going on in this market.

32792 (Winter Park): Cash Sales as a Percentage of Closed Salesl

All right. So we have the same phenomenon happening here in 792 and 789 cash sales are collapsing.

Okay. This is happening all over the state of Florida since March. This is not a phenomenon that’s unique to any area.

So it’s, we, I couldn’t tell you the answer for that, but Jared, why are, why is the cash buying collapsing? I don’t know. It’s not investors either. This investors were down long ago.

They were pulling back on selling. They weren’t buying all the housing cash. It was the mom and pops, the regular buyers coming from international coming from local coming from in the U S they pull back.

Look what happened. So pre COVID this marketplace is around 20, maybe 30% of all their sales from cash. That’s kind of average.

It elevated during 2022. Everybody had money in their pocket and it stayed elevated and slowly drifted down and to early 2024, but look what’s happened consistently sense. Okay.

Down five down 61% month before last down 23 down 27 consistently through moving season, cash purchasing was not there at the same time. Interest rates were hovering at seven and a quarter. So now you have a huge problem for the market.

Ultimately tells me a lot as to what’s going on in many of these markets in this particular market. Clearly, whenever this many cash buyers pull back in a higher interest rate environment, it’s having its effect. And ultimately unsold homes are stacking.

32792 (Winter Park): New Pending Sales

The most recent month on record was negative 40%. So in October, look at this 16 homes were put in our contract in one single month.

That is a problem. When you have a hundred listings on the market and there’s big declines in the past nine days, obviously that’s going to have an effect on the housing market.

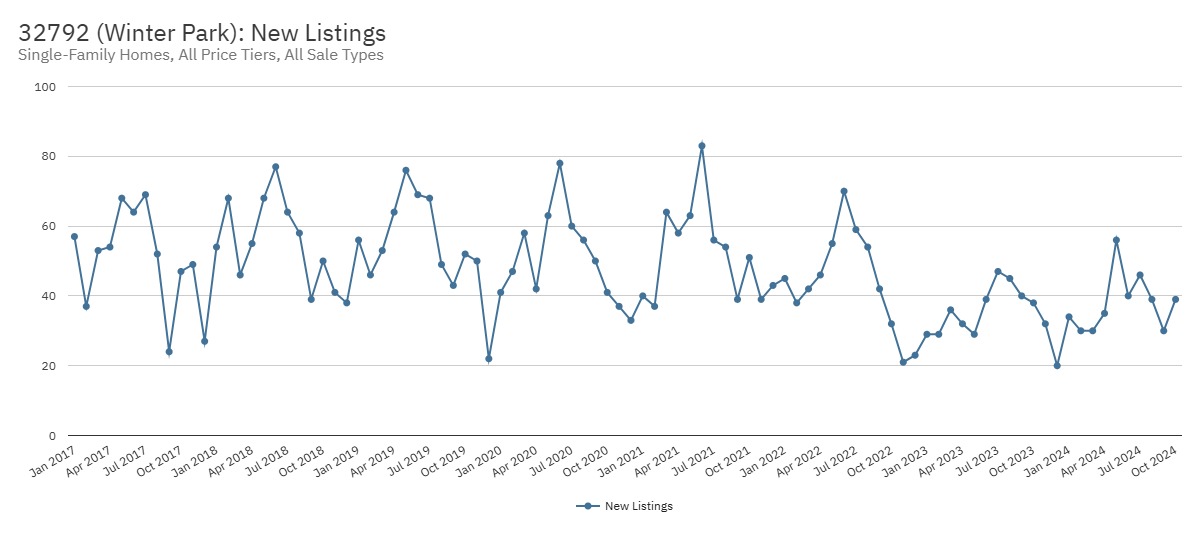

32792 (Winter Park): New Listings

This is a saving grace, my friends, because for the most part recently, there has not been a huge surge. This market would be completely in a different place. If your sellers were active, a lot of sellers here, they don’t necessarily have to sell, or maybe they’re just taking a look around the neighborhood going.

There’s a lot more signs in the front yard right now and none of them have sold on them. And so they’re just getting a feel. And sometimes there’s that internal notification that says, Hey, you know what? It’s a bad time to sell.

I’m not going to do it. However, I will tell you, my friends, these patterns do not hold just like in 79, the next door neighbor, this usually swings the other way. So usually when you have negatives, they usually dive the other direction.

I’ll take case in point. I’ll show you after you had some very slow months, look at this only was up nine down 16, only up three. You had a 93% jump in May, which surged new listings.

Look at that 56 listings in a single month. You imagine that you’re selling 16 or 20. That is a big amount of homes without a lot of buyers to pick them up.

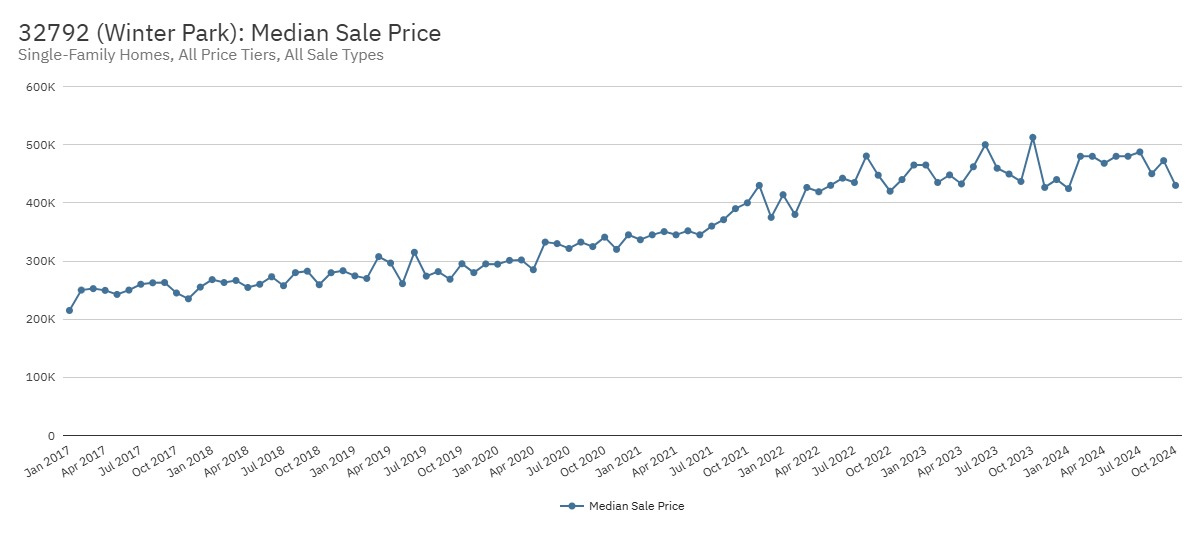

32792 (Winter Park): Median Sale Price

This is median sale price. This is a great indicator because it’s not heavily swayed by the high end and the low end.

Look at what’s happening. This particular market looks a little different than 79, where it’s very consistent, but it was holding flat for the last two years. And look at the last three months.

See that move that shows me that there’s some buyers trending, some better prices in this particular market. So you have an opportunity buyers where you’re going to have sellers feeling competition in seven, nine, two, and it’s an opportunity and sellers. There’s some very unique things you can do to capture buyers in a market like this.

If you don’t have an agent that knows the data and understands how to incentivize, pull the buyer your way in a situation where there’s a sea of you competing for a few buyers, you need to make sure you’re making good decisions on who you hire. Yes, I do work in real estate in winter park.

32792 (Winter Park): Months Supply of Inventory

Last chart I want to show you is called months of supply.

This is the ultimate measure of supply and demand for the market. Look at that. That’s a perfect picture.

Folks, buyers dive. They’re not there in the Tories high. It shoots straight up.

Now here’s the deal. This particular market’s norm is right here. Okay.

Two and a half, 2.6, 2.7. Right now it’s a 3.1. It’s elevated for this market. It’s not ridiculously long, but if these conditions persist, this is going up here, 3.5, 3.8, four months of maybe four months of supply here in the very near future. If things do not abate, I don’t necessarily think they will because interest rates seemingly have been worse since this data.

So the cash buyers aren’t there. Interest rates are higher. This might be one of the best buying.

When this goes up, buying opportunities are amazing. If you want to, you want to get a good deal, get some great credits on a purchase here. Give me a call.

I’ll help you out. But you’ve got a window of opportunity before spring probably brings this down a little bit where buyers can have some of the best opportunities to purchase here than they’ve had in years, in years, maybe at any point in a seven-year history.

Why Choose Jared Jones?

As a top real estate agent with nearly 4,000 homes sold and over 20 years of experience in the Florida real estate market, I have the expertise needed to help you navigate today’s evolving landscape. Whether you’re looking to buy or sell, my deep understanding of market trends and personalized approach will provide you with the insights and strategies required for success.

Best Realtor in Winter Park, Florida - Reach Out Today!

If you’re ready to make a move in Florida’s real estate market, don’t hesitate to reach out. Contact Jared Jones at 407-706-5000 (call or text) or email info@jaredjones.com for professional guidance and personalized service that will help you achieve your real estate goals.

Search Homes in Winter Park, Florida

Jared Jones Real Estate Team Serving All of Central Florida

- Osceola County

- Orange County

- Lake County

- Polk County

- Seminole County

- Volusia County

- Broward County

- Marion County

- Flagler County

- Brevard County

- Pinellas County

- Hillsborough County